Managing Millions

PROVO, Utah – Mar 10, 2021 – Since 1935, people have been playing Hasbro’s Monopoly or The Game of Life board games, where players make decisions about how to best invest their hard-earned tokens and game currency to win the game. But for students involved in the Silver Fund, an investment class at the BYU Marriott School of Business, there’s no need for Monopoly money or investment games. Every semester, these students in the Silver Fund walk the walk by managing more than three million dollars of real investments through trading stocks.

The Silver Fund class (MBA 629A, MBA 629B) was created when its namesake Harold Silver donated $274,000 to BYU Marriott. Brandon Bates, BYU Marriott adjunct professor and Silver Fund faculty member, explains that the Silver Fund is a student-run fund where students are divided into groups and assigned to cover different industries. The groups then become experts in those industries and make recommendations regarding which stocks in those industries to buy, sell, or sell short. The recommendations are presented to the Silver Fund class to obtain feedback and assess risks. Class members ultimately vote on whether or not to implement the actions recommended by the theses of the different groups.

But the Silver Fund class goes beyond simply buying and selling stocks. “Analyzing a stock is one thing,” Bates explains. “Feeling sweat bead on your brow and tension build in your jaw as the market eviscerates your investment is another.” Bates shares that Silver Fund students confront the mental and emotional challenges of living with the uncertainty that accompanies owning risk and investing. “Students learn by experience that a collaborative research culture coupled with a disciplined process helps tame some of that uncertainty,” he says.

Alex Shigeta, a senior from Honolulu studying finance, is one of the Silver Fund students learning, among other skills, to cope with the challenges of owning risk. He says the biggest lesson he has learned from the class is the difficulty of selecting a suitable equity in which to propose investments. “Recently, markets have been pretty wild,” Shigeta says, referring specifically to the GameStop stock incident that occurred late January 2021.

For students in the class, researching the ever-changing stock market means more than reading the current stock figures. “Everyone in the class is trying to determine things that the general market doesn’t know,” says Shigeta. “Participating in this class has been a beneficial experience.” He sees the rigor of researching stocks as skill-building experiences that will benefit him long after he graduates from BYU Marriott. “The class’s thorough investigation has been a great learning experience. The knowledge I have gained from this class will be useful in my future career,” he says.

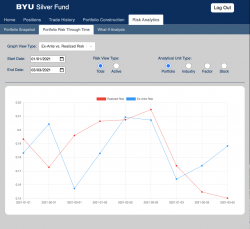

As the Silver Fund class evolves, faculty have started to find ways to give students easier access to quantitative tools. “Brandon Bates and I have enlisted a talented group of student software engineers and quantitatively minded students to build an analytics suite,” says Brian Boyer, the BYU Marriott H. Taylor Peery Fellow associate professor of finance and Silver Fund faculty committee member. “The tools being built by students at BYU rival those used in industry. With those tools, Silver Fund students will have the bandwidth to focus their energy on selecting good investments after appropriately controlling for risk."

Sam Earnest, a senior from Redmond, Oregon, double-majoring in computer science and economics, is one of the computer programming students who was hired to work for Silver Fund in writing code for the new web application. He and other students who study computer science work together to create and enhance the interface, or analytics suite, that makes quantitative tools easier for the students to use. During his experience in helping the Silver Fund, Earnest was inspired to add an economics major to his major in computer science. “It’s been fun to work with a team that’s so bright and hardworking,” he says.

As the stock market continues to change, the Silver Fund will continue to evolve to meet its students’ needs. "We're just in the beginning phases here," says Boyer. "As the class moves to expand its investment model to handle other asset classes, I'm excited for the potential opportunities we will have. I feel like we're just getting started."

Media Contact: Chad Little (801) 422-1512

Writer: Rebecca Nissen