Talk to any cheese importer, student studying abroad, or retired couple finally realizing their dream to see the Sistine Chapel, and you're bound to hear that leaving the United States hurts, especially in the pocketbook.

Americans abroad are being hit by the unexpected "American tax," as the value of U.S. currency has dropped in comparison to others such as the euro, pound, and yen. As a result, that Murano glass vase from Venice, Italy, now costs 25 percent more than it used to. So what happened to the all-dominant dollar? Can it maintain its rule over world financial markets or will younger upstarts—namely the euro—steal its scepter?

The U.S. dollar sits at the heart of an international economy invisible to most. Trillions get traded daily to cover the cost of the tele- vision set bought from Japan, breakfast fruit imported from Mexico, and shirts tailored in India. For many foreign governments and individual investors the dollar is a secure investment instrument—serving as the world's primary reserve currency for more than half a century.

Hal Heaton, a Marriott School professor of business management, likes to tell his students about Citibank in Sao Paulo, Brazil, that was dealing with off-the-charts inflation during the 1980s. At one point interest rates hit 58 percent—a month! To help its clients deal with the country's swollen economy, the bank chartered a Boeing 747, filled it with U.S. currency—$20, $50, and $100 bills—and flew it to Brazil, where the cash was dis- tributed to the bank's wealthiest clients, who abandoned local currency for something more stable.

While few would argue the dollar has abdicated its dominant role, its clout seems to be slipping. Whether this means the dollar is headed for collapse or experiencing some temporary heartburn that will remedy itself largely depends on your point of view. ere is no question, though, that the value of the dollar is down. In July 2002, a euro cost $0.98; three years later, that same euro cost $1.21, a 23 percent jump, which means the dollar could buy less. So far that's mainly good news for foreigners, especially those using euros—a currency that has taken off.

"People are worried because they're sitting on such huge quantities of dollars at the same time that the United States has a huge trade deficit," Heaton explains. "The question is, are investors going to be willing to hold as many dollars? What if they simply stop buying, and nobody steps in to buy those treasuries?”

But, it’s not just a strong euro that worries investors. Japan’s government still holds hundreds of billions in U.S. Treasury Bonds while the dollar’s value has fallen by roughly 20 percent against the yen in recent years. So why are the Japanese investing in the United States instead of themselves? “Well, if the Japanese government were simply to stop buying, it would have a huge impact,” Heaton says. By selling their U.S. T-Bonds, Japan could cause the dollar’s value to decrease and the yen to increase, but that would make Japanese goods more expensive for Americans and raise unemployment levels in Japan, something the country isn’t looking for.

The Dollar’s Rise

While predicting the future is a risky undertaking, understanding the historic role and strength of the dollar may shed some light on likely scenarios.

“In the late 1800s, if you wanted to build a cross-country railroad or put in Alexander Graham Bell’s new telephone system, virtually every country in the world got its money from London,” Heaton says. “London was the banking capital of the world, and the currency of the Empire on which the sun never set—the pound sterling—was the world currency.”

Some fifty years later, England, together with the whole of Europe, was in shambles after two devastating world wars. Lee H. Radebaugh, a Marriott School accounting professor and international business expert, explains that after World War II, the International Monetary Fund was established, and the dollar, “just by virtue of how we came out of the war,” became the major reserve currency.

“After World War II,” he adds, “there was a tremendous amount of pent-up demand in the United States because all of our resources and consumption had been directed to the war. So when the soldiers came home and the military economy went down, consumer demand went right through the roof, and the United States began growing like crazy.”

In addition, all the money that went to Europe and Japan through the Marshall Plan was sent in U.S. dollars. Heaton adds, “If a country wanted any of the major technologies—jet engines, television transmitters, radar, transistors—it was all coming out of the United States, and every major country in the world kept billions and billions of dollars in deposits in U.S. banks.”

The Dollar’s Decline

But as in most of life’s arenas, it’s hard to remain on top. The dollar is no exception. The British pound still holds some sway, and Japan’s postwar rise to prominence led to the yen becoming a major player in world currency markets as well.

More recently, a new player on the international currency field, the euro, has affected the dollar’s dominance. The mere existence of the euro is a bit of a surprise to Radebaugh, given the Germans’ historic attachment to the mark, which traditionally has been the strongest currency in Europe. The idea of a common European currency had been talked about as early as 1957. Nevertheless, it took several failed attempts and more than forty years to materialize. The euro started in 1999 for commercial transactions and in January 2001 as a tangible public currency.

The idea for a common currency developed, in part, because other countries wanted the same benefits the United States enjoyed from being the world’s reserve currency, which provided the advantage of hundreds of billions of dollars of free money, Heaton explains. “Europe has always had suspicions about America, and there’s been sort of a rocky relationship.”

Europe also had other reasons for instituting the euro, specifically the need for free trade. “They could see that in the twenty-first century, you had to have a certain sized business to get the economies of scale,” Heaton says. “There were so many separate countries in Europe that they could never get sufficient sized businesses, and there were trade barriers that kept putting them at cost disadvantages. So they eliminated the trade barriers as they implemented a common currency.”

But Europe set its sights on a bigger goal. “They hoped they would have a currency big enough—meaning enough transactions, and trillions of dollars in various securities, and enough stability—that they would get the additional benefit of becoming the world’s reserve currency,” Heaton explains. When more people and countries buy into a currency, making it their reserve, it remains more stable .

When the euro came into being, it initially dropped so much in value—by nearly 30 percent over two years—that it looked like it might be a failure. But then several factors breathed life into the euro, increasing both its value and standing in international monetary circles.

Radebaugh provides a thumbnail perspective of the events leading to the euro’s rise and the dollar’s decline. Those include the bubble bursting on the dot-com explosion and the tragedy of September 11, 2001. At the same time, the European Central Bank kept interest rates higher to combat inflation while the Federal Reserve relaxed theirs, causing investment dollars to flow into the Euro zone. Radebaugh also points out two additional factors that led to the dollar’s decline and the euro’s rise: the United States’ budget went from a $128 billion surplus in 2001 to a $157 billion deficit in 2002, brought on in part by the war in Iraq, and a huge trade deficit, $362.7 billion in 2001 and $421.2 billion in 2002.

However, it’s the budget deficit here at home that is more of a factor than the trade deficit because its something that we have control over, Radebaugh says. “By allowing the dollar to fall, we can hopefully reverse a bit of the trade deficit; but by controlling our budget deficit, we reduce the need to borrow more money. The only way the government borrows money is through the sale of treasury bills or bonds,” he says.

As for the trade deficit, Radebaugh explains, “We are the engine of growth for the world, so why would we have a big trade deficit? Because everyone is using us as a place to export to, Americans are absorbing imports from abroad because our economy is growing. On the other hand, our companies are trying to export to other countries, but their economies are weak, and there aren’t enough markets to sell to. While imports are going up, exports are going up too—but very slowly, even with a weak dollar. Another reason for the deficit is the rapid rise in oil prices. Higher prices mean higher imports, with the economy still booming and demanding imported oil.” Since 2000, U.S. imports increased 22 percent to $1.8 trillion in 2004. However, exports only went up 7.5 percent to $1.2 trillion during the same period.

But don’t think all Americans are losing out. A weak dollar makes American exports more competitive, which puts Europe at a disadvantage and underscores the complexity of the global economy.

The Dollar’s Future

Not surprisingly, there are critics who see gloomy prospects on the horizon. Radebaugh, however, holds a more optimistic view: “Everybody points out that we have this huge budget deficit and that people are not going to buy treasury bills. I’ve been hearing that for twenty years, and they still keep buying treasury bills because the U.S. economy is strong. If you look at a country’s power—political, military, and economic—the United States is the only country that has all three.”

Even in landlocked Utah, some businesses are dealing with these financial exchanges daily. Just ask Ali Manbeian, Jason Langston, and Ryan Gibbons, all partners in Salt Lake City-based Global Positioning Solutions, Inc. The team spends its days providing foreign exchange services and has an up-close view of the dollar and its relation to foreign currencies. “From an economic standpoint, the dollar is under enough pressure as it is,” Gibbons says. “With high oil prices and account deficits, there is a possibility of a currency crisis. The dollar is still the super currency, but the euro is on its tail—and very close.”

Langston adds, “In the last year—as the dollar has had difficulties—some countries began pulling their reserves out of dollars and putting them in euros. In big countries like Japan, Russia, and China, large trading companies are pulling their U.S.-based assets and selling them in favor of the euro. There is more liquidity that we’re seeing.”

Manbeian summarizes GPS’s approach to helping businesses navigate the waters of foreign currencies by noting, “The euro opened against the dollar at $1.20, went to .77 cents, then to $1.38, and now it’s on its way back down. The happy medium is typically right in the middle of all that. Right now where the dollar sits with the euro isn’t in a good spot, but it’s better than it was three months ago, and three months from now we’ll see where it is again.”

The evidence would indicate that there is not a crisis yet. Heaton notes the Bush administration is beginning to address the relevant issues, although not to everyone’s satisfaction. But what is the future of the dollar? Will it continue to dominate or will it head into a free fall?

“It’s hard to forecast the future,” Radebaugh responds. “If the dollar continues to slide, at some point people who are buying treasury bills may decide they would rather invest somewhere else. What would that lead to? The stock market could drop, but the government still would need money. The only way to get that is through treasury bills, so the Fed would have to raise interest rates to increase the attractiveness of T-bills.”

There are other areas where unsuspecting Americans may feel the effect of a strong euro and a weak dollar. Heaton adds, “If interest rates suddenly rose significantly, you’re going to get major unemployment. That may not only affect your employment but also your ability to sell your house and buy a new one. If that nightmare scenario occurs, you’re going to feel it in your pocketbook.”

It seems likely that the dollar will continue to maintain its dominance as the world’s reserve currency—and that the United States will benefit from the dollar’s supremacy. The yen will likely continue to play a role as well, and the euro seems to be settling in for the long haul as a major currency. Nonetheless, many experts believe budget deficits do need to decline, and the trade imbalance needs to be corrected.

Heaton and Radebaugh both urge caution and restraint as those concerned with the dollar look for ways to strengthen its value. “It’s not a crisis unless something bad has happened,” Heaton says. “I think President George W. Bush has handled the situation appropriately. I get nervous anytime governments intervene in the markets, because they can distort prices. And businesses have seen the distortions created by government intervention and have started to exploit them, which creates additional problems.”

Heaton also gives the current administration credit for working behind the scenes to make adjustments in trade agreements and in other factors that affect the dollar. “There are a lot of trade negotiations going on in the background, but it’s not highly visible to the average consumer. In that sense, Bush is doing what Ronald Reagan did in the 1980s to stop the dollar’s decline.”

The dollar has certainly been through its ups and downs, which can affect Americans in ways we don’t always see. But its historic strength—and the strength of the country that stands behind it—would suggest that it will, indeed, continue its reign.

_

Article written by Jim Bell

About the Author

Jim Bell is the manager of marketing and communications for BYU Broadcasting and was the editor of BYU Today from 1983 to 1997. He is the author of two books, Marathon of Faith, co-authored with Rex and Janet Lee, and In the Strength of the Lord: The Life and Teachings of James E. Faust.

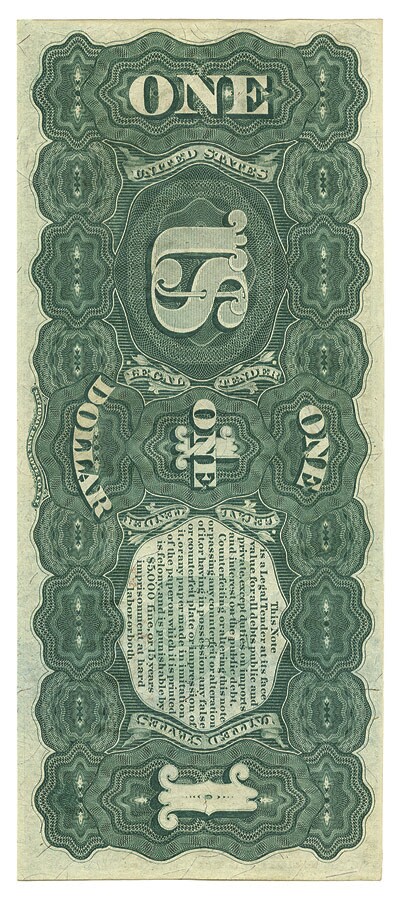

Opening image courtesy of Dave Hur, American Coin Co. Image on pg. 6 courtesy of Rust Rare Coin, Salt Lake City.